“You Saved. You Planned. You Did Everything Right…

Now the College System Is Punishing You For It.”

Why are families like yours being asked to pay $80,000/year...

...while others pay $30K or less for the same degree?

It’s the hidden cost of success

and it’s draining retirements.

See how to protect your savings and send your child to a great-fit college.

Click below and join our FREE workshop:

Inside This Free Training, You’ll Discover How to:

Over 34,000 families have used this system. You can too!

- Legally qualify for scholarships and grants — even if you earn $250K+

- Protect your savings, assets, and 529's from financial aid formulas

Unlock hidden merit aid (even at private schools that look “too expensive”) - Avoid the “middle class squeeze” that punishes families who did everything right

- Cut $70,000 or more from college costs — without student loans

Register for the Free Workshop Now

There’s a Playbook. Colleges Use It Against You.

And that's costing you tens of thousands of dollars.

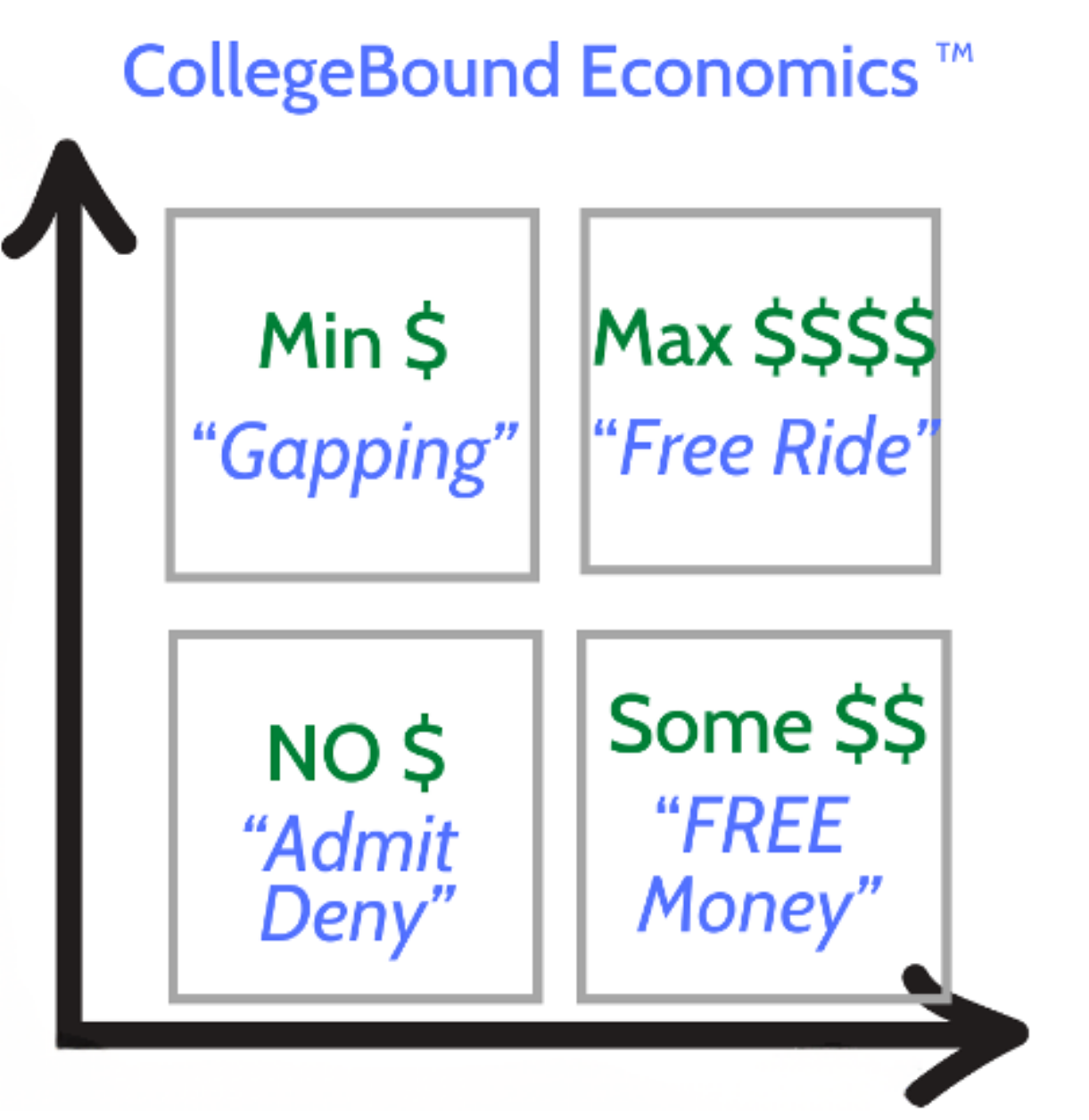

I call it "CollegeBound Economics."

Most families think college aid is about income. It's not.

Colleges award FREE gift aid based on two factors:

Student Positioning (How desirable is your student?)

Financial Positioning (How able are you to pay)

These two factors create four possible outcomes, and only ONE leads to optimal aid.

If you're a high-income family, you're likely in the bottom left quadrant—high eligibility but still able to pay.

Result: You pay nearly full price.

However, there's a way to move to the top right quadrant—where you can access maximum FREE gift aid.

The college wants your student, but they understand you won't pay full price.

So they cover the difference with FREE money.

That's what I teach in my free workshop.

Colleges Are Targeting Your Wallet!

-- as reported May 2025 in the New York Times

If your family earns $150K or more, you might feel stuck—too "rich" for aid, too smart to overpay.

Now, it’s confirmed: The New York Times reports colleges are profiling families like yours before you even apply.

They’re not just reviewing applications; they’re using algorithms to decide what to charge your family.

Watch Now ->

Are You in the College 'Funding Gap?

The uncomfortable middle: Too “rich” for aid. Not rich enough to write $80K checks.

- If you're earning $100,000 to $400,000 per year, you're stuck in "the funding gap."

- You make too much for most need-based financial aid.

- But you don't make enough to comfortably write $30,000 to $90,000-per-year tuition checks without sacrificing your retirement.

There is a solution. Watch the video:

The 3-Step Process That’s Helped 34,000+ Families Save $70K+ on College

Step 1:

Academic Modeling

"Position your child where schools will PAY YOU to attend"

You'll discover how to identify schools where your child is in the top 25% academically. These schools offer the most merit aid because they want students like yours.

Outcome: $20,000-$40,000 per year in merit scholarships (even if you "make too much" for need-based aid)

Step 2:

Financial Aid Modeling

"Strategically position your assets to maximize aid eligibility."

You'll learn how to legally reposition your assets to increase your aid eligibility—without hiding money or breaking any rules.

Outcome: $10,000-$30,000 per year in additional need-based aid

Step 3:

Retirement Preservation

" Protect your retirement while paying for college."

You'll discover how to create a plan that keeps your retirement accounts intact while funding your child's education through strategic aid positioning and smart college selection.

Outcome: Your retirement stays on track while your child attends their dream school

What You’ll Learn in the Workshop:

-1-

Why some parents pay $70K/year… and others pay $0 for the same school

-2-

Why Most Parents Miss 56% Discounts (New York Times, 2025)

-3-

How high-income families legally reduce their Student Aid Index (SAI)

-4-

Why writing a big tuition check could wreck your retirement — and how to avoid it

-5-

What colleges won’t tell you about merit aid (and how to get it anyway)

-6-

Why Waiting 6 Months Can Cost Tens of Thousands

"Colleges don’t offer aid. They assign prices —based on how much pain your family can tolerate."

— The New York Times, May 2025

Claim Your Spot — Space is Limited

Real Families, Real Results

Three case studies showing how to get FREE money for college

Case Study #1: Julie

A private college ends up being cheaper than a community college and State-U.

Case Study #2: Sarah

Negotiating for more financial aid at a private college. The final net cost was reduced to the same as CU Boulder.

Case Study #3: The Lampert Family

Securing a 58% discount at expensive private colleges.

Watch now ->

See how real families legally unlocked thousands in free money.

Click here and discover how to get similar results for your family:

What previous parents had to say:

"You really open our eyes about the possibility of having our son attend a private school. We think he would do better in a smaller school but didn't think it was in our means. Now we realize that it is."

Patrick K., teacher

"I found this very helpful. How to and when to communicate with my child on how important picking schools in advance is. I came out feeling much more positive about how I will pay for our daughter's school."

Diane P., manager

"Great insight into the "business" of college applications and needs versus merit-based aid. This kind of information should be made available to all parents of graduating seniors."

Tom B., government

"Thank you. It was an eye-opener and great information. I will not sleep tonight. Definitely a course that must be offered and attended by every college-bound family."

Aziz Y., federal government

"I strongly urge parents and students to attend this course. Not only are there insights on affording college, but you offered key insights into the business side of the selection and financial aid process. A true eye opener."

Denison O., diplomat

"This was very educational and awakening for me. I walked away feeling hopeful I can pay and get three kids through college. And I can retire without extra hardships. Thanks so much!"

Lisa T., employee relations director

Meet Peter Lampert

CPA, Tax Attorney, Fiduciary Financial Advisor, and College Funding Specialist who’s helped 34,000+ families save $70K on average using legal strategies colleges hope you never learn

Don’t pay more than you need to. Start saving on college costs — without sacrificing your retirement.

Discover how 34,000+ families legally saved $70,000+ — and protected their retirement.

Join our FREE workshop and discover the proven system that protects your retirement. Workshops filling fast - Limited seats available!

Register for the Free Workshop Now